Foreclosure & Bankruptcy: What You Need to Know

Bankruptcy can be a potential option for homeowners facing foreclosure, providing a legal way to address overwhelming debt and possibly stop the foreclosure process. Bankruptcy is a legal process that allows individuals or businesses overwhelmed by debt to seek relief. When you’re unable to make your mortgage payments and other debts are piling up, filing for bankruptcy may offer a fresh start. It can temporarily halt foreclosure proceedings through an automatic stay, giving you time to reorganize your finances. However, bankruptcy is not a one-size-fits-all solution and comes with long-term financial consequences. It’s important to carefully consider your options and consult with a bankruptcy attorney to determine if this route is right for you.

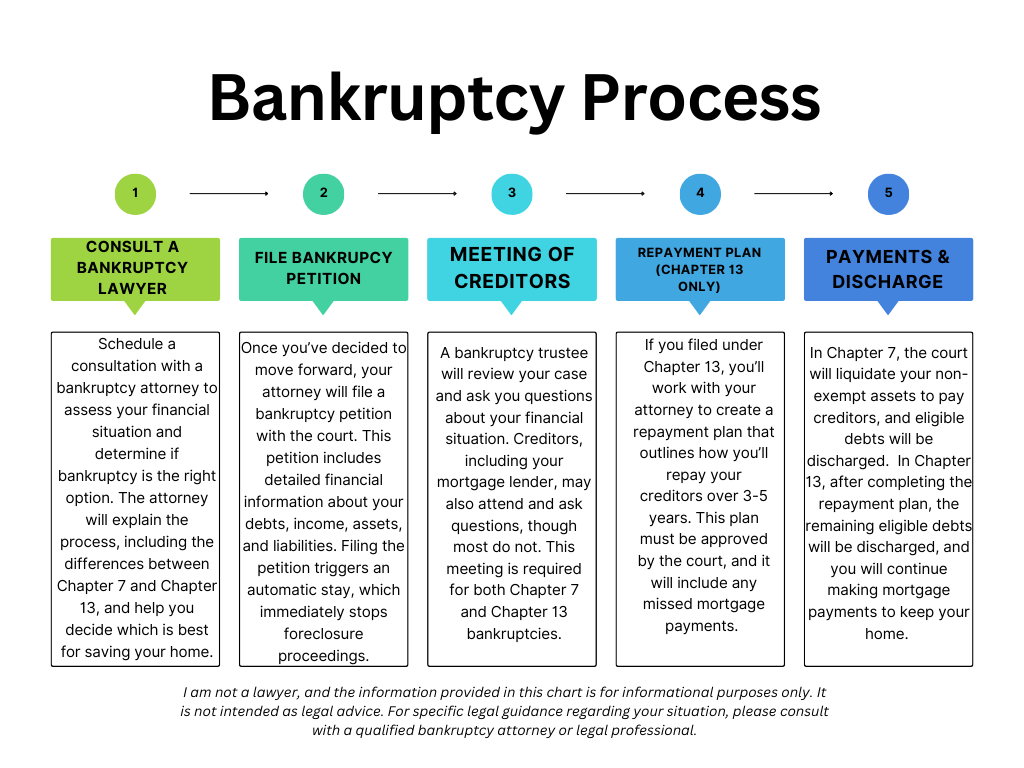

Typical Bankruptcy Process

The typical bankruptcy process begins with filing a petition with the court, along with detailed financial information about your debts, income, and assets. This triggers an automatic stay, which halts creditor actions like foreclosure, wage garnishments, and collections. Depending on the type of bankruptcy (Chapter 7 or Chapter 13), the next steps will vary.

After filing, the court will hold a meeting with creditors, and a trustee will oversee the process. Once the plan is confirmed or assets are liquidated, the court will issue a discharge order, officially eliminating most of the debtor’s eligible debts.

Bankruptcy can provide a fresh start, but it comes with long-term consequences, so it’s important to weigh all options carefully. It is important to note that bankruptcy will not erase your monthly mortgage payments. Bankruptcy may give you time to catch up, but you will still need to continue making payments moving forward.

Things to Think About

Filing for bankruptcy to stop foreclosure is a significant decision with both advantages and challenges. Here are some important factors to consider

- Bankruptcy Does Not Eliminate Mortgage Payments– While bankruptcy can halt foreclosure temporarily through an automatic stay, it doesn’t erase your obligation to make monthly mortgage payments. If you want to keep your home, you must stay current on your mortgage moving forward. Have you experienced a temporary financial setback and are now in a position to maintain your payments? If your financial circumstances remain unchanged, you could find yourself facing the same challenges within a year, now with the added burden of a bankruptcy on your record.

- Credit Impact– Although your credit has likely already taken a hit from your missed mortgage payments, bankruptcy can negatively impact your score as well and it will remain on your credit report for up to 10 years. This can make it more difficult to qualify for loans, rent housing, or even secure certain jobs.

- Asset Risk – If you file for certain types of bankruptcy, non-exempt assets may be liquidated to repay creditors. While your primary residence may be protected under a homestead exemption, other assets, like valuable sentimental items, could be at risk.

- Eligibility Requirements– Bankruptcy has strict eligibility criteria. If you fail to meet these requirements, your case may not be approved.

- Long-Term Financial Consequences – Bankruptcy can provide temporary relief, but it’s not a guaranteed solution. If the financial issues that led to the foreclosure are not addressed, you may find yourself struggling again in the future.

Consult a Legal Professional

Consulting a legal professional is essential when considering bankruptcy as a solution for foreclosure. An experienced bankruptcy attorney can help you understand the process, determine which type of bankruptcy is best for your situation, and ensure all paperwork is completed correctly. They can also explain the long-term financial implications and help you create a plan to protect your home. Bankruptcy laws are complex, and having legal guidance can make the difference between a successful outcome and further financial difficulties.

If you’re considering bankruptcy to address foreclosure, I can connect you with legal professionals who can guide you through the process and help you make informed decisions. Don’t hesitate to call for a referral tailored to your needs. Call me at 757-231-9047.