Foreclosure & Loan Modification: What You Need to Know

Loan modification is an effective option for homeowners looking to avoid foreclosure by adjusting the terms of their mortgage. A loan modification is a change to the original terms of a mortgage loan, typically made to help a borrower avoid foreclosure. The modification can include adjustments to the interest rate, extension of the loan term, reduction in the principal balance, or changes to the monthly payment amount. For homeowners facing temporary financial hardship, loan modification can provide the breathing room needed to get back on track.

Before we dive in, I want to be clear: while this option may sound promising and seem like a potential solution, it’s important to fully understand the details. If the circumstances that led to the foreclosure have not been resolved, it is highly unlikely that the loan modification will be approved.

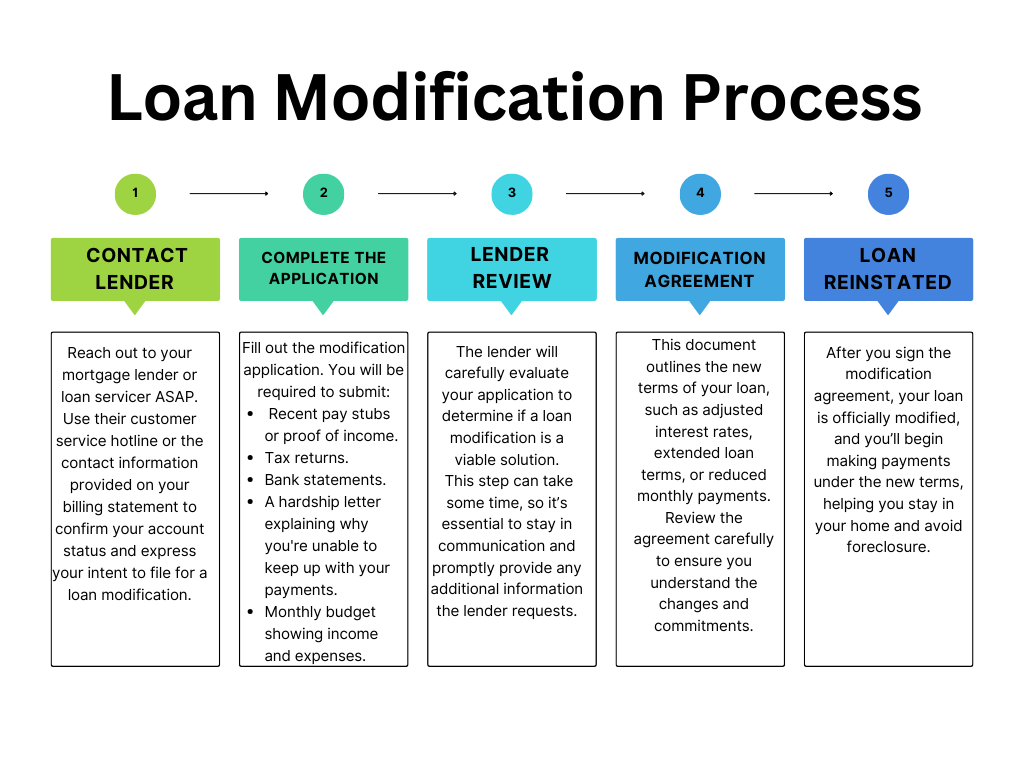

Typical Loan Modification Process

Loan Modifications typically take up to 90 days to approve, so you need to IMMEDIATELY call your lender if you would like to pursue a loan modification. You’ll need to submit financial documentation, such as income proof and a hardship letter. The lender will review your situation and determine if you qualify for a modification. If approved, you may be placed on a trial payment plan to demonstrate you can manage the modified payments. Once successful, the lender will finalize the modification, outlining the new loan terms. You’ll then make the adjusted payments allowing you to avoid foreclosure and stay in your home.

A loan modification offers significant benefits, but it also comes with challenges that homeowners should weigh carefully. Let’s explore the pros and cons to help you make an informed decision.

Pros of Loan Modification

- Lower Monthly Payments– A loan modification can reduce your monthly payments by lowering your interest rate, extending the loan term, or even reducing the principal balance, making it more affordable.

- Avoid Foreclosure – By modifying your loan, you can prevent foreclosure, stay in your home, and avoid the long-term impact of losing your property.

- Improved Financial Stability – A successful loan modification can give you the opportunity to reset your mortgage, putting you back on track without the burden of missed payments or penalties.

Cons of Foreclosure Reinstatement

- Not Guaranteed – Getting a mortgage modification approved when a house is in foreclosure is not easy, and the majority of applications are denied.

- Additional Fees– Some lenders may charge fees during the modification process, and you could be responsible for paying legal or processing fees, which can add to the financial burden.

- Short Timeframe – Lenders typically set a strict timeline for loan modifications and this limited timeframe can make it difficult for homeowners to gather the necessary documents and gain the necessary approval before the house is foreclosed on.

- Extended Loan Term– The loan term is often extended and includes accumulated interested and fees from the foreclosure, meaning you end up paying even more interest over the life of the loan.

- Impact on Credit Score – Although a loan modification can prevent foreclosure, it may still negatively impact your credit score, making it harder to secure future loans or credit.

Beware of Scams

Beware of fraudulent loan modification companies that prey on homeowners facing foreclosure. These fraudulent companies may promise quick fixes, charge high upfront fees, or offer unrealistic guarantees, all while offering little to no real help. They often take advantage of vulnerable individuals by misleading them into paying for services that don’t lead to meaningful results. To protect yourself, always work directly with your lender or a HUD-approved housing counselor, and be cautious of any company asking for payment before offering any services. Remember, legitimate loan modifications are typically free and handled through your lender.

If a loan modification sounds like it could help, call your lender immediately. If you have more questions about loan modifications or foreclosure process, I am happy to help. Call me at 757-231-9047.