Foreclosure Reinstatement: What You Need to Know

Foreclosure reinstatement is a powerful option for homeowners facing foreclosure. It allows borrowers to save their homes by bringing their loans current. Reinstatement is a viable solution for homeowners who can secure the necessary funds and want to stay in their homes. This is the time to tap into forgotten 401Ks, sell high-value personal items, ask friends and family for help, and explore every potential avenue for resources to reinstate your mortgage. This option is only worth pursuing if you are confident you can keep up with your payments moving forward.

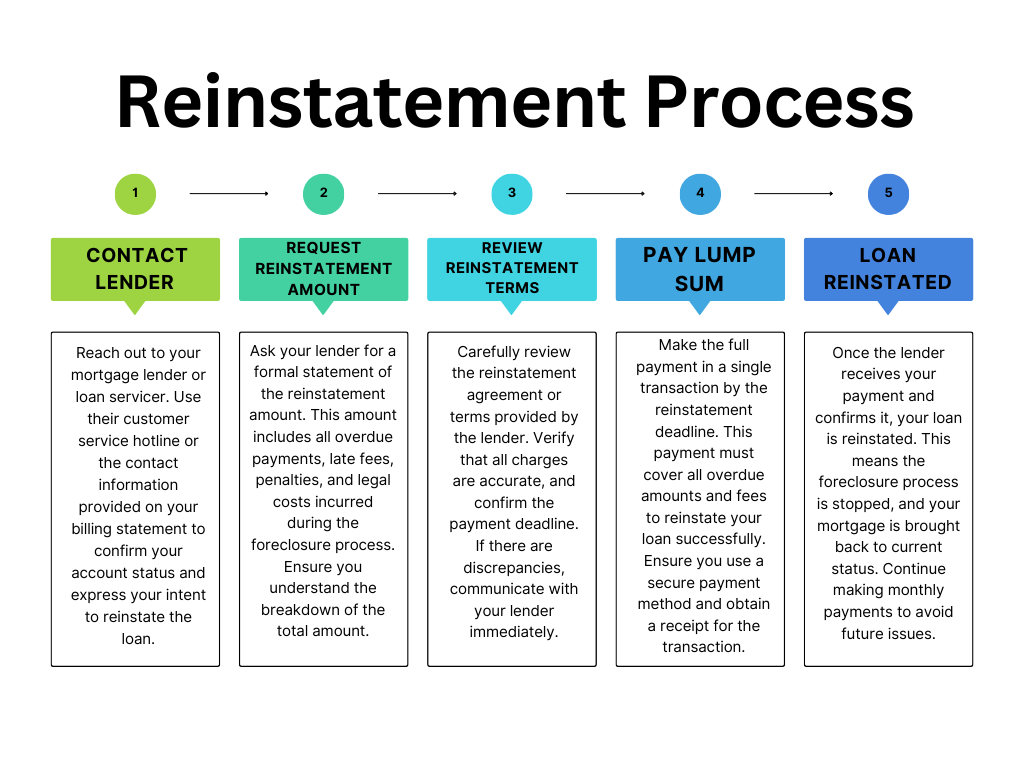

Typical Reinstatement Process

Reach out to your lender IMMEDIATELY if you would like to start the reinstatement process. On the call, express your intentions to bring your mortgage up-to-date. Ask for the reinstatement amount, which is the total amount necessary after fees, penalties, and legal costs have been added. Upon receipt of the reinstatement agreement, check all charges to ensure accuracy. If this all looks good, you will pay the total amount in a lump sum to your mortgage company, which will bring your mortgage current. Your lender will then reinstate your loan and you will continue making monthly payments to avoid future issues.

While reinstatement has distinct advantages, it also comes with challenges that homeowners should carefully consider. Let’s break down the pros and cons to help you make an informed decision.

Pros of Foreclosure Reinstatement

- Save your Home – The most significant advantage of reinstatement is that it stops the foreclosure process and allows you to keep your home. By paying the overdue amount, you bring your loan back into good standing and avoid losing your property.

- Avoid Further Credit Damage – Foreclosure has a severe impact on your credit score and can stay on your report for up to seven years. Reinstating your mortgage prevents the foreclosure from being finalized, which can help mitigate further damage to your credit.

- Preserve Equity – If you have significant equity in your home, reinstatement allows you to protect your investment. Selling a foreclosed home at auction often leads to a lower sale price, which could diminish your equity.

- Stop Additional Costs – Foreclosure proceedings often come with accumulating legal fees, late payment penalties, and other charges. Reinstating your loan promptly halts these additional costs.

Cons of Foreclosure Reinstatement

- Requires a Lump Sum Payment – One of the biggest drawbacks is the need to pay the full amount of overdue payments, including penalties, interest, and fees, in one lump sum. This can be a significant financial burden for many homeowners.

- No Guarantee of Long-Term Stability Damage – Reinstatement resolves the immediate issue of foreclosure but doesn’t address the underlying financial challenges that caused the missed payments. Without changes to your budget or income, you could risk falling behind again.

- Short Timeframe – Lenders typically set a strict deadline for reinstatement, often requiring payment before the foreclosure sale date. This limited timeframe can make it difficult for homeowners to gather the necessary funds.

- Does Not Reduce Monthly Payments– Unlike loan modifications, reinstatement does not adjust your monthly mortgage payment or interest rate. If your payments were unaffordable before, they’ll remain the same after reinstatement.

- Additional Fees Can Be High – The reinstatement amount often includes legal fees, late penalties, and other costs. These charges can add up quickly, making the total reinstatement amount higher than expected.

If reinstatement sounds like it could help, call your lender immediately. If you have more questions about the reinstatement or foreclosure process, I am happy to answer your . Call me at 757-231-9047.